Matteo Sandrone and Harry van Sprundel

Why CFOs & CROs Should Act Now

Introduction

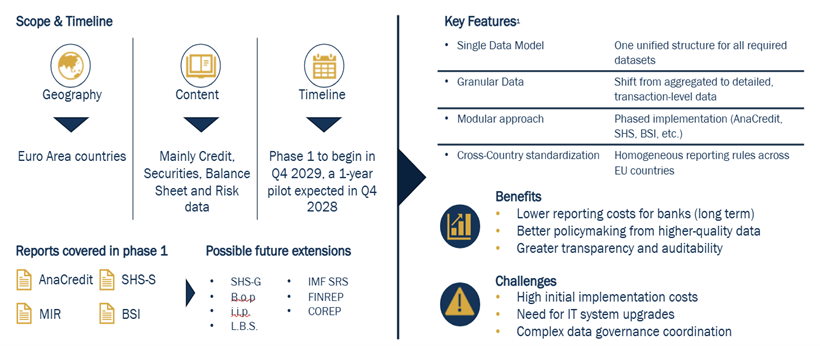

By 2029, all euro area banks will be required to comply with the Integrated Reporting Framework (IReF), a new regulatory architecture introduced by the European Central Bank (ECB) to consolidate and harmonize statistical reporting. This shift will replace today’s fragmented system of national templates and overlapping reports (AnaCredit, SHS-S, MIR, BSI…) with a single, modular, and granular reporting standard across the eurozone. A one-year pilot begins in 2028; full implementation is mandatory the following year.

At first glance, IReF may appear to be just another compliance obligation. In reality, it is an opportunity for banks to modernize their internal data landscape. Institutions that act early can move beyond tactical compliance and leverage IReF as a strategic enabler: consolidating legacy systems, improving data quality, reallocating operational FTEs, and building future-proof reporting infrastructure aligned with supervisory expectations.

This article explores the structural inefficiencies that IReF seeks to resolve, the supporting role of the Banks’ Integrated Reporting Dictionary (BIRD), and the strategic and quantitative rationale for early adoption. For CFOs and CROs, the message is clear: proactive engagement with IReF can generate long-term value far beyond regulatory compliance.

The Current Reporting Landscape: Fragmentation and Inefficiency

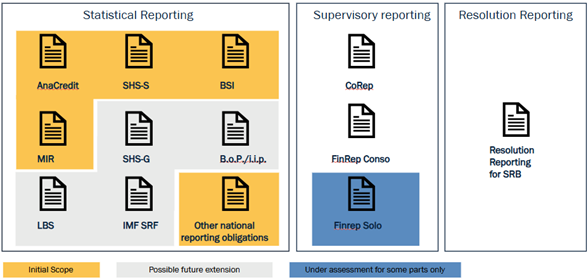

European banks today must comply with a patchwork of statistical reporting requirements. Since the euro’s inception, regulatory reporting grew organically and remains largely fragmented by country. Banks must submit thousands of data points across multiple frameworks, for example balance sheet (BSI), interest rate (MIR), securities holding (SHS), and granular credit data (AnaCredit), often with overlapping content with the prudential frameworks (i.e. COREP). National authorities layer on extra requests despite some harmonization, so each jurisdiction has its own data models, transmission formats, and definitions.

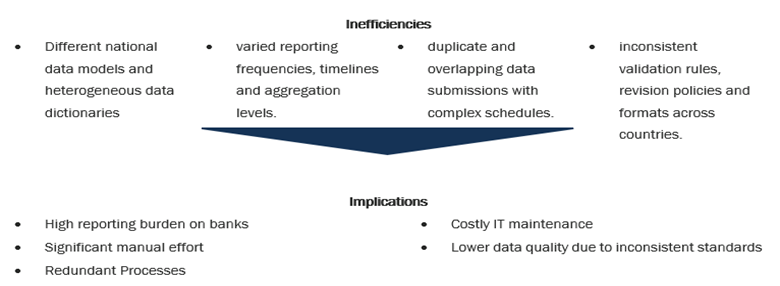

This fragmentation leads to 4 main inefficiencies:

- Different national data models and heterogeneous data dictionaries.

- Varied reporting frequencies, timelines and aggregation levels.

- Duplicate and overlapping data submissions with complex schedules.

- Inconsistent validation rules, revision policies and formats across countries.

The implication is a high reporting burden on banks, significant manual effort, redundant processes and costly IT maintenance, all while data quality suffers due to inconsistent standards.

Introducing the Integrated Reporting Framework (IReF)

IReF is the European Central Bank’s initiative to fix these inefficiencies by harmonising and integrating banks’ statistical reporting across the euro area. In essence, IReF will replace the multiple legacy reports with one single standardized data collection, initially covering banks’ balance sheet and interest rate statistics, securities holdings, and granular credit data. Notably, IReF is designed with proportionality, it limits requirements for smaller banks, and it may be adopted by non-euro EU states, encouraging a truly pan-European standard. According to the ECB’s latest timeline, the first reporting that is covered by IReF will be Q4 2029.

How IReF Solves Fragmentation

IReF promises to “standardise reporting obligations, reduce redundancies and overlaps, minimise the reporting burden and enhance data quality”. By defining and collecting once, it streamlines data flows that today are duplicated. Banks operating in multiple countries stand to benefit greatly: instead of tailoring reports to each national template, they can follow one consistent EU-wide schema. Over time, IReF is a stepping stone toward broader integration of regulatory reporting (bridging statistical with prudential and resolution reports). For example, Europe’s Joint Bank Reporting Committee (JBRC) has been established to advise on eventually aligning statistical reports under IReF with supervisory (EBA) and resolution (SRB) reporting in the future. Crucially, IReF will also shift the paradigm from template-based aggregates to more granular, data-driven reporting. As the ECB observes, implementing IReF means “stepping away from aggregated, template-based reporting and moving towards the delivery of more granular data, such as information on loans, derivatives, securities, and deposits”. This granular approach, much like the AnaCredit loan-level dataset, is expected to improve the richness and quality of information available to regulators and banks alike.

BIRD: A Bridge to Integrated Reporting

If IReF is the destination, the Banks’ Integrated Reporting Dictionary (BIRD) is a key part of the journey. BIRD is a collaboratively developed data dictionary and methodology, created by the ECB, national central banks, and industry experts, aimed at helping banks map their internal data to the new integrated requirements. In practical terms, BIRD provides a detailed model of how to transform raw bank data into regulatory reports, specifying which source data should be used and how to process it to meet each data point definition. The goal of BIRD is to alleviate the reporting burden by giving banks a common interpretation of regulatory definition. In other words, rather than each bank individually deciphering new reporting standards, they can rely on the BIRD blueprint to reduce guesswork and ensure consistency.

BIRD plays an important role in supporting the implementation of IReF. It serves as a reference model linking input data (banks’ own records) to output reports under IReF, thus helping banks identify data gaps and necessary transformations early. Notably, BIRD is designed in tandem with IReF; the European Banking Federation (EBF), acting as co-secretariat of BIRD, is working with the ECB to ensure BIRD and IReF are fully aligned. This alignment means that once IReF is implemented, banks using BIRD can directly apply its data models for the new statistical reports, greatly simplifying implementation.

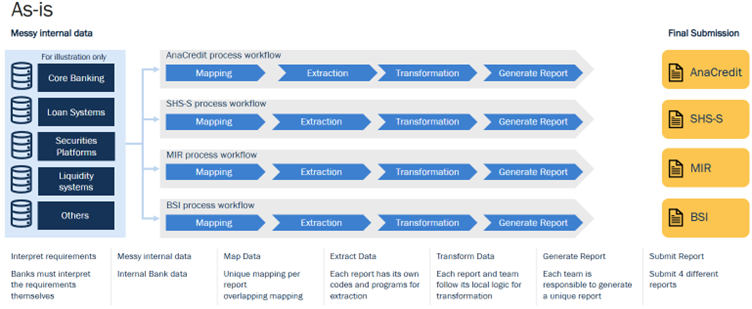

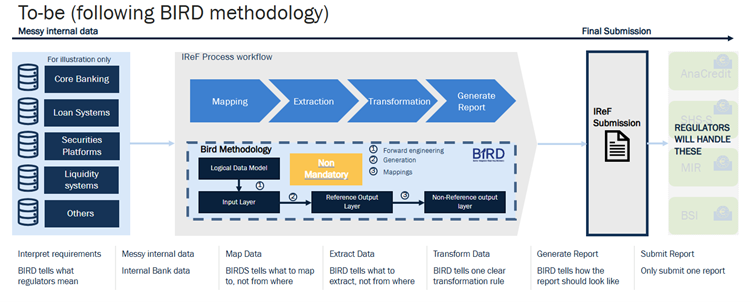

It’s important to note that BIRD itself is not a regulatory mandate, it’s a voluntary resource and not a plug-and-play IT solution. Early adopters can find it useful, but banks are not obliged to use BIRD, and uptake has been gradual. One reason is that until IReF is in force, BIRD’s standard definitions might not perfectly match each country’s existing national templates; indeed, BIRD does not automatically account for every national specific requirement in today’s frameworks. Implementing BIRD under the current fragmented system can require country-specific adjustments, limiting its immediate benefits. The full payoff of BIRD is expected only when IReF and BIRD are implemented together in a harmonized way. In short, BIRD gives forward-thinking banks a head starts in the transition, by standardizing data at the source, but it isn’t a silver bullet. Banks still need to invest in aligning their systems and governance to the IReF/BIRD model. In this context, BIRD serves as a ‘Design accelerator’: it provides a common language and templates, which can significantly cut implementation time, but banks must still do the heavy lifting of data cleaning, integration, and IT enablement around that framework. The figure below shows how the as-is and to-be of statistical reporting.

Strategic Advantages of Early Adoption

For CFOs and CROs, regulatory projects are often seen as compliance costs to be minimized. IReF, however, presents an opportunity to unlock strategic value beyond compliance. Embracing IReF (and BIRD) early, well before the 2029 deadline, can deliver tangible financial and operational benefits:

1. Efficiency Gains & Cost Savings: An integrated reporting system allows consolidation of reporting processes and IT systems. Banks can decommission redundant reporting software and interfaces, cutting maintenance costs. Internal teams currently duplicating efforts for different reports can be streamlined. For example, a bank might reallocate Full-Time Equivalents (FTEs) from manual data reconciliation to higher-value analAAytical work once duplicate reports are eliminated. The ECB’s own cost-benefit analysis found that a broad majority of banks (68% of respondents, representing ~76% of euro-area banking assets) expect the long-term benefits of IReF to outweigh the costs. These benefits include lower ongoing compliance costs after implementation and efficiencies of scale, especially for cross-border banks that stand to replace multiple country-specific processes with one standard approach. Early adopters can start accruing these savings sooner, improving the net present value (NPV) of the investment.

2. Data Quality & Risk Insights: By moving to a single source of truth for regulatory data, banks can dramatically improve data quality. IReF will enforce consistent definitions and validation rules, which reduces errors and misalignments that now occur between different reports. Higher data quality not only helps regulators but also benefits the bank’s own risk management and finance functions. CFOs will gain more confidence that reported figures (e.g. on credit exposures, deposits, interest margins) truly reconcile with internal records, and CROs can draw more reliable risk insights from the integrated datasets.

3. Simpler Future Compliance & Agility: Regulatory change is continual. Implementing IReF early forces a forward-looking overhaul of data architecture that can make the bank more agile in the face of future requirements. A modernized, integrated data model means that when regulators inevitably ask for new metrics or expansions (e.g. integrating prudential data into a future “IReF 2.0”), the bank can adapt faster and at lower incremental cost. It’s noteworthy that IReF’s design tries to minimise the cost of any further changes to the data collected. By being an early mover, a bank essentially future-proofs its reporting infrastructure and avoids the cliff-edge risk of a last-minute rush (with all the associated project risk and expensive temporary fixes). Early adoption also affords time for a smoother implementation (including robust testing, staff training, and phasing) rather than a costly last-minute approach under regulatory pressure.

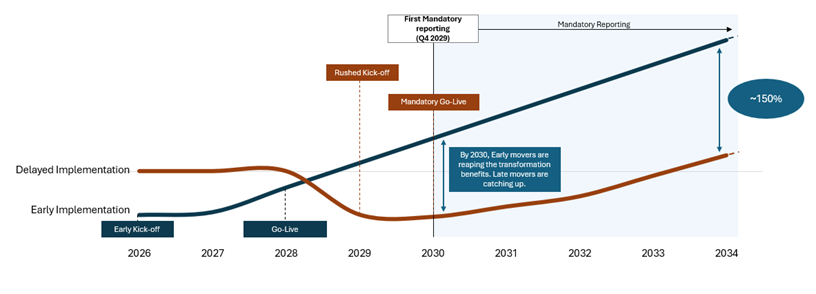

Early adopters begin investing sooner (incurring implementation costs up front) but also start reaping efficiency gains and savings earlier, leading to a higher cumulative net benefit over time. Delayed adopters might avoid near-term costs, but by deferring the overhaul they also postpone the benefits and then face a steep one-time expense closer to the deadline. As the figure illustrates, an early adopter could reach a breakeven point (net benefits zero) well before 2030, whereas a bank that waits might still be “in the red” at that point and only catch-up years later. In net present value terms, the early move is financially favourable in most scenarios we’ve modelled. Of course, every bank’s numbers will differ, but the message is consistent: there is a real option value in proactive implementation. Banks can front-load the project, then enjoy years of smoother, cheaper reporting operations that free up resources and management attention for other priorities.

The figure below illustrates the value of starting IReF implementation early. Banks that initiate the transformation in 2026 will frontload capital investments but can go live by 2028. By the time mandatory reporting begins in 2030, these early adopters are already operating at positive cumulative cash flow, having reaped early benefits from automation, streamlined processes, and reduced manual effort. In contrast, banks that delay the rollout face compressed timelines, higher execution risks, and prolonged negative cash flows for up to three years post go-live.

While the exact outcomes will vary depending on each bank’s transformation readiness, our estimates consolidate cost assumptions across capital expenditures (e.g., IT infrastructure, reporting tools) and operating expenditures (e.g., training, licenses), against quantified benefits from direct labour savings, internal efficiencies, and broader strategic gains. Based on this analysis, early adopters can achieve up to 150% greater cumulative project value by 2034, showing that proactive implementation delivers not just compliance, but meaningful financial returns.

Conclusion

For European banking CFOs and CROs, the upcoming Integrated Reporting Framework and BIRD initiative should be seen not just as a compliance obligation, but as a strategic opportunity. Yes, adapting to IReF will require upfront investment, in data infrastructure, systems integration, and project resources, but the potential returns are multifaceted: streamlined operations, lower long-run costs, better-quality data, and enhanced analytical capabilities across finance and risk. Early adoption, supported by tools like BIRD, offers a chance to shape the outcome, phase in changes at a manageable pace, and reap benefits well before the 2029 deadline. By contrast, waiting until the last minute could mean higher costs, greater operational risk, and forfeited years of efficiency gains. IReF is the banking sector’s opportunity to capture the former while avoiding the latter.

As executives responsible for the financial stewardship and risk oversight of your institutions, you should ask: Can we afford not to act until compliance forces us? Leading banks are already mobilizing IReF programs, to secure first-mover advantages. The Integrated Reporting Framework is more than a regulatory change; it’s a catalyst to modernize how banks manage data. Those who move early will not only sleep better when the ECB’s deadline looms; they will likely discover new value in their data, reduced costs, and a stronger platform for whatever reporting demands come next. In the evolving landscape of EU banking regulation, IReF and BIRD represent a chance to turn a mandatory project into a strategic win. Now is the time to plan, invest, and lead the way toward integrated reporting excellence.

What’s next

At Mount Consulting, we support financial institutions in transforming regulatory challenges into strategic advantages. From initial IReF readiness assessments to BIRD-aligned implementation roadmaps, our team brings the expertise to streamline data architecture, reduce long-term costs, and improve reporting agility.

The timeline for IReF may extend to 2029, but the opportunity to build smarter, leaner, and more integrated reporting systems starts today.

Is your institution ready to move from compliance to competitive advantage?

Let’s start the conversation.

Want to know more?

We like to talk about our business and how we can help you!